Conventional

The definition of a conventional mortgage is simply any mortgage not backed by the Federal Government. Whereas FHA loans are insured by the government and VA loans are guaranteed by the government, conventional loans are not. Conventional mortgage loans can either be “conforming” or “nonconforming”.

A conforming mortgage loan is defined as a loan that meets Fannie Mae’s and Freddie Mac‘s lending requirements. It’s important for banks to issue loans that meet these requirements because most mortgages are ultimately sold by the lender to Fannie Mae or Freddie Mac.

Conforming

Conventional Conforming Mortgage Pros:

- You no longer have to pay monthly private mortgage insurance once you have 20%+ equity in the home. (Put 20% down and you can completely avoid this cost.)

- Depending on your credit, mortgage insurance may be less expensive than FHA mortgage insurance.

- Required down payments can be as low as 3%.

Conventional Conforming Mortgage Cons:

- If you have marginal or low credit scores you will not qualify.

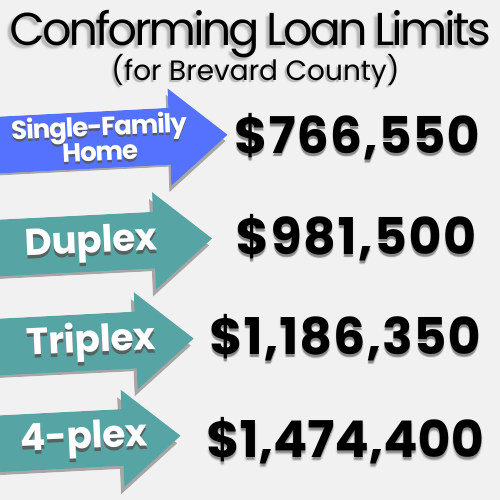

- The conforming mortgage is limited to $766,550 in 2024 for single-family homes.

Non – Conforming

Non-conforming loans can come in any shape or size, but a common type of non-conforming loan is a “jumbo mortgage” which is used when the amount of loan is greater than the conforming loan limit. For 2024, the conforming loan limit is $766,550 in Brevard County.

Non-Conforming Mortgage Pros:

- You can obtain high dollar loans.

- The loan terms can be flexible.

Non-conforming Mortgage Cons:

- Higher minimum credit scores are required.

- A lower debt-to-income ratio is required.

- Interest rates will likely be higher.

- Typically a minimum of a 20% down payment is required.